-

2103 Room NO.322 Xinggang One Road,Haicang District,Xiamen Fujian,China

Land Evaluation and Classification for Solar Power Facility Sites

For landowners with idle property, the idea of installing a solar power generation facility can be attractive. However, before proceeding, it’s essential to understand the land classification (用途区分) and how such development might affect the land’s assessed value, which in turn impacts property taxes.

Installing a solar facility can increase the value of the land, but this doesn’t always translate into pure profit—it can also result in higher taxes. This article explains which land categories (地目) are suitable for solar installations and how land valuation changes after installation.

Table of Contents

Suitable Land Types for Solar Facility Installation

To install a solar power generation facility, the land should fall under specific classifications:

Typical Applicable Land Classifications

- Mixed-use land (雑種地)

- Wilderness (原野)

- Forest land (山林)

- Residential land (宅地)

Among these, 雑種地 (zasshuchi) refers to land that doesn’t fall under the standard categories defined in asset evaluation standards—like paddy fields, pastures, or ponds—and is commonly considered a flexible category for solar installations.

For land not originally categorized as residential or forest, a land-use conversion application may be required before installing a solar facility.

📌 Always check the current classification of your land before starting a project.

Land Evaluation After Installing a Solar Facility

Solar project sites are often considered “special use” lands, making valuation challenging. However, three main principles typically apply when assessing such land:

Key Evaluation Criteria

- Use “bare land” value based on land improvement (grading) costs

- Ensure the assessed value remains within reasonable limits of the surrounding land market

- Maintain valuation balance with neighboring properties

Even though solar panels are depreciable assets and not counted as part of the land’s intrinsic value, the land is often evaluated as if it were undeveloped (bare land), with consideration for site preparation costs.

This means that the assessed value won’t skyrocket due to the facility itself, but inconsistencies in assessment methodology can still occur, making it difficult to justify the valuation in some regions.

A Look at Japan’s System: A Case Study

In Japan, municipal governments use a combination of fixed asset tax standards and actual use to determine land value. For solar facilities, this often results in nuanced evaluations, especially when land types like “forest” are repurposed for energy projects.

This methodology is increasingly adopted in other regions to ensure fair taxation across growing renewable installations.

Common Mounting Options for Ground-Based Solar Facilities

If you’re planning a ground-mount solar project, here are popular and durable support systems:

🔗 Ground Solar Mounting System

🔗 C – Steel Ground Mount – Screw Pile Foundation

🔗 Aluminum Ground Mount – Screw Pile Foundation

🔗 Ramming Pile Ground Mounting System

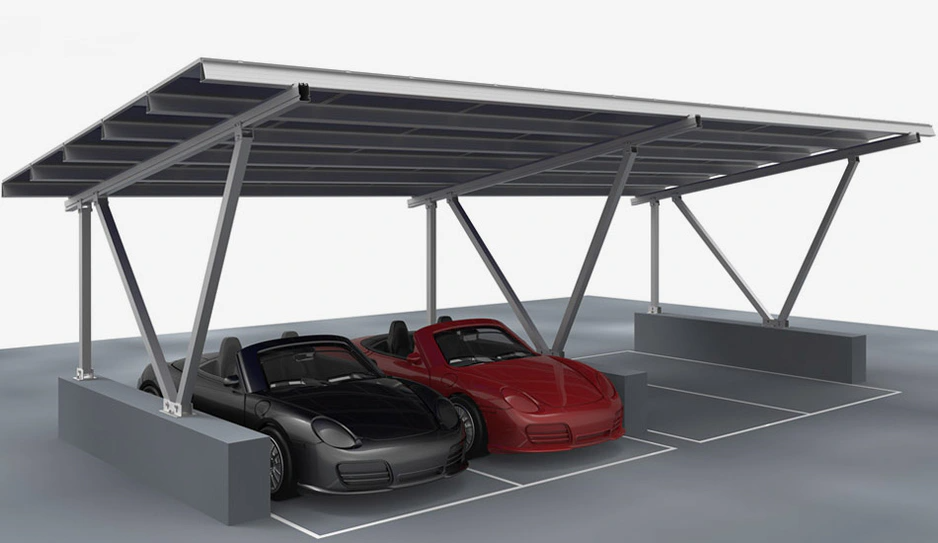

Image Gallery

Below are example systems often used for solar facility sites:

Aluminum Ground Mount with Screw Pile

Ramming Pile Mounting System

Concrete-Based C-Steel Mount

Final Thoughts

As this guide illustrates, installing solar power facilities doesn’t necessarily cause land value to spike, but it does introduce complexity into land assessment. Proper documentation, cost justification, and understanding of classification laws are critical.

Whether you’re in Japan or a similar regulatory environment, it’s wise to consult professionals familiar with land use conversion and tax implications of renewable infrastructure.

🌞 Need a reliable supplier for mounting structures?

Choose Firstsolar – your partner in long-lasting, high-quality solar infrastructure.